S&P, Nasdaq End 3-Day Slide; Nvidia Jumps 6.8%, Google, Microsoft Hit New Highs; Oil Down 1%

FOMC voter and Federal Reserve Governor Bowman made a hawkish statement, saying that he would be willing to support interest rate hikes if inflation does not continue to improve. He believes that now is not the right time to start cutting interest rates, as there are multiple upward risks to the inflation outlook, and he expects no interest rate cuts in 2024.

Analysts have noted that recently, several Federal Reserve officials have stated that they need to wait for "some time" and have more data showing a cooling of inflation before discussing interest rate cuts. San Francisco Fed President and this year's voter Daly refused to preemptively cut interest rates to combat labor market deterioration and economic slowdown.

However, another voter, Federal Reserve Governor Cook, said on Tuesday that it would be appropriate to cut interest rates "at some point," as the risks to employment and inflation targets are more balanced, and he expects inflation to slow down more rapidly by 2025.

In the United States, the Conference Board's consumer confidence, present situation, and expectations index all declined in June, with respondents expecting the proportion of business conditions to improve in the next six months falling to the lowest since 2011. The S&P/Case-Shiller U.S. National Home Price Index for April has cooled somewhat from its highs.

After four consecutive months of easing pressure, Canada's CPI inflation rate accelerated again to 2.9% year-on-year in May, posing an obstacle to the Bank of Canada's interest rate cut in July, and the US dollar fell more than 40 points against the Canadian dollar in a short period. In addition, the market still expects the Federal Reserve to cut interest rates twice this year.

FedEx's annual profit outlook exceeded expectations, thanks to deep cost reductions, and its stock price rose by 15% after hours. Analysts say that its financial reports are usually leading indicators of the U.S. economy. "Tesla's arch-rival" Rivian received a $5 billion investment from Volkswagen in Germany, and its stock price rose by 46% after hours.

The S&P and Nasdaq indexes stopped their three-day losing streak, while the Dow fell for the first time in six days, with Google and Microsoft hitting new highs, and Nvidia rebounding by 6.8%.

On Tuesday, June 25th, the U.S. stock index trends continued to diverge, with the Dow opening low and falling, falling more than 410 points or 1% at its lowest during the session, briefly losing the 39,000-point integer position, with Walmart's component stock falling by 3.4%, detaching from its historical high and creating the largest drop in two months. The Philadelphia Bank Index fell by more than 1.2%. The S&P 500 index and the Nasdaq, aided by the rebound of chip stocks such as Nvidia, opened high and rose, with both the Nasdaq and chip stock indexes rising by more than 1%. The U.S. technology stock index ETF and the biotechnology index ETF led the gains.

As of the close, the S&P 500 index, the Nasdaq, and the Nasdaq 100 all stopped their three-day losing streak, with the S&P detaching from a one-week low, the Nasdaq detaching from a two-week low, and the Dow stopping its five-day winning streak and detaching from a nearly five-week high:

The S&P 500 index closed up 21.43 points, a gain of 0.39%, at 5,469.30 points. The Dow closed down 299.05 points, a drop of 0.76%, at 39,112.16 points. The Nasdaq rose by 220.84 points, a gain of 1.26%, at 17,717.65 points.The Nasdaq 100 rose by 1.2%, while the Nasdaq Technology Market Value Weighted Index (NDXTMC), which measures the performance of technology stocks in the Nasdaq 100, increased by 1.8%, both having previously fallen for three consecutive days away from new highs. The Russell 2000 small-cap index fell by 0.4%, and the "fear index" VIX dropped by over 3%, losing its hold above 13.

The S&P and Nasdaq halted their three-day losing streak, with the Dow Jones experiencing its first decline in six days.

JPMorgan Chase's Chief Market Strategist, Marko Kolanovic, warned that while declining inflation data fuels hopes for interest rate cuts, it also suggests that economic growth is a cause for concern and could be one of the main risks facing financial markets in the next phase. Strategists at BNY Mellon also stated that if economic data continues to weaken, stock market gains will not be sustainable unless the possibility of a Federal Reserve rate cut in September becomes more likely.

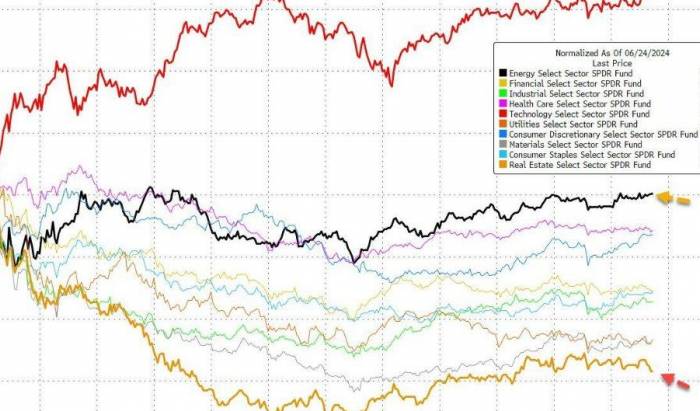

On Tuesday, the U.S. technology sector rebounded, standing out among others.

Star technology stocks rose together. "Metaverse" Meta increased by 2.3% to its highest in over ten weeks, Google A rose by 2.7% to another all-time high, Amazon rose by 0.4% approaching a six-week high, Tesla increased by 2.6%, and Netflix rose by 0.5%, moving away from a one-week low; Apple rose by 0.5% for two consecutive days, with a market capitalization of $3.21 trillion, ranking second in the U.S. stock market; Microsoft rose by 0.7% to another all-time high, with a market capitalization of $3.35 trillion, making it the largest in the U.S. stock market.

Semiconductor stocks rebounded after a significant correction over three days. The Philadelphia Semiconductor Index rose by 1.8%, and the industry ETF SOXX increased by 1.5%, both moving away from a two-week low. Nvidia rose by 6.8%, ending a three-day losing streak and moving away from a three-week low, after having fallen by 6.7% yesterday, which was the largest drop in two months, with its market capitalization returning to over $310 billion, ranking third in the U.S. stock market, and the Nvidia double long ETF rose by nearly 14%; however, Broadcom fell by 0.7% for five consecutive days, moving away from its highest; Qualcomm rose by 0.7%, ARM increased by over 6%, TSMC and Lam Research in the U.S. stock market rose by 2.8%, Applied Materials rose by 1.9%, Micron Technology turned positive by 1.5%, all having previously moved away from new highs for three consecutive days; Intel rose by 0.6%, AMD fell by 2.4% and then closed flat.

AI concept stocks saw more gains than losses. CrowdStrike rose by 2.3%, having previously moved away from new highs for four days, Oracle fell by 0.5%, also moving away from new highs for four consecutive days, SoundHound.ai fell by 1.5%, BigBear.ai rose by over 6%, C3.ai fell by over 1%, Snowflake fell by 0.5% to a 17-month low, Palantir rose by 1.7%, Adobe rose by 0.5%, Dell rose by 2%, Super Micro Computer rose by about 2%, and IBM fell by 1.4%.

In terms of news, the sell-off that wiped $430 billion from Nvidia's market capitalization has temporarily paused, with traders looking for support levels from charts. Oppenheimer's Head of Technical Analysis, Ari Wald, stated that the long-term trend remains strong, with the stock price far above the 50-day moving average of $101 and the 100-day moving average of $92. Bank of America reiterated its "buy" rating for Nvidia and included it in its best stocks list. The European Union accused Microsoft of violating antitrust rules by "abusing" the bundling of the popular productivity applications in Office 365 with its Office suite and Teams, a collaborative communication tool. Goldman Sachs reiterated its "buy" rating for Microsoft, expressing optimism for substantial returns on investments in generative AI. Evercore ISI reiterated its "buy" rating for Apple, anticipating the potential for increased iPhone revenue. Wells Fargo reiterated its "reduce" rating for Tesla, with quarterly deliveries potentially falling below 400,000 electric vehicles, while Royal Bank of Canada lowered its second-quarter delivery forecast for Tesla by 23% to 410,000 units. Eli Lilly's stock reached a new high, following a partnership agreement with OpenAI.

Chinese concept stocks retreated. ETF KWEB fell by 1.4%, CQQQ fell by 1.9%, and the Nasdaq Golden Dragon China Index (HXC) fell by 1.3%, approaching 5,900 points, marking the sixth day of decline in seven trading days, returning to a near ten-week low.

Most popular individual stocks declined, with JD.com falling by 2.8%, Baidu falling by 0.2%, and Pinduoduo falling by 1%. Alibaba fell by 1.3%, Tencent ADR fell by 0.8%, Bilibili fell by about 3%, NIO fell by 1.6%, XPeng Motors turned positive by 1%, Li Auto fell by over 2% and then turned positive by 0.1%, Faraday Future fell by 33% and then closed down by nearly 19% at a six-week low, with the board approving a reverse stock split, BYD ADR fell by nearly 1%.In terms of news, Baidu's Wenxin flagship model is offered for free for the first time, and Tongyi Qianwen announces the OpenAI user migration plan. Berkshire Hathaway further reduces its holdings in BYD, bringing the stake to 5.99%.

Other stocks with significant changes include:

Carnival Cruise Line rises by 8.7% to a near six-month high, with unexpected profits in the second fiscal quarter and revenue exceeding expectations. The company raises its full-year profit forecast, stating that leisure demand in 2025 will be stronger than this year, and trip prices will increase.

SolarEdge Technologies, a photovoltaic component power optimizer company, falls by over 20% to a seven-year low, planning to issue $300 million in private convertible preferred bonds with a maturity date of 2029. A customer who owes the company $11.4 million has filed for bankruptcy.

Novo Nordisk shares in Europe rise by 4%, reaching an all-time high with its US stocks, as semaglutide is approved in China for long-term weight management, achieving an average weight reduction of 17%. Zealand, a European stock with a weight loss drug concept, rises by 9.5%, jointly driving the Danish stock index up by 2.7% to a new high.

Airbus shares in Europe fall by over 12% and then by over 9%, while its US stocks fall by over 6% and then by 1.8% to a seven-month low. The company lowers its pre-tax profit target and commercial aircraft delivery expectations for 2024, facing ongoing supply chain issues and an additional cost of €900 million for the space systems division.

European stocks generally decline, with German stocks leading the losses. The pan-European Stoxx 600 index closes down by 0.23%, marking the third day of decline in seven days, with the technology and industrial sectors falling by more than 1%, leading the decline. The Stoxx European Aerospace and Defense index once fell by 5%, marking the largest drop since November 2021.

US Treasury yields largely erase the slight gains made during the day, with short-term European bond yields showing a relatively larger increase.

Awaiting the key inflation data on Friday, US Treasury yields rise slightly and then fall again.

During the trading session, the US Treasury Department issues an additional $69 billion in two-year Treasury bonds, with a winning rate of 4.706% (4.917% on May 28) and a bid multiple of 2.75 (previously 2.41). At that time, US Treasury yields were still hovering at their daily highs, with some analysts stating that the $70 billion five-year Treasury bond auction on Wednesday will further illustrate potential demand trends.The two-year U.S. Treasury yield, which is more sensitive to monetary policy, once rose by 2 basis points and approached 4.76%, with U.S. stocks basically erasing gains at the end of the day. The 10-year benchmark bond yield increased by more than 1 basis point to 4.26%, and U.S. stocks turned down to 4.24% at the end of the day, more than a week ago, U.S. Treasury yields had fallen to the lowest level since early April in ten weeks.

The benchmark 10-year German bond yield in the eurozone slightly fell to trade at 2.41%, while the two-year yield slightly rose. The 10-year UK bond yield slightly fell, and the two-year yield rose by more than 2 basis points, following data showing that Canadian inflation unexpectedly accelerated.

Oil prices fell by 1%, with U.S. oil losing $81 and Brent oil approaching $85, moving away from the highest in eight weeks.

Oil prices rose and then fell back. WTI crude oil futures for August closed down $0.80, a drop of more than 0.99%, at $80.83 per barrel, reaching the highest since the end of April last week. Brent crude oil futures for August closed down $1, a drop of more than 1.16%, at $85.01 per barrel, moving away from the highest since April 30th, which was reached yesterday at $86.

U.S. oil WTI once fell the deepest by $0.91 or more than 1% during the day, losing the integer position of $81, and had consecutively set the highest for seven weeks for three trading days last week. The more actively traded international Brent September futures once fell by more than $1 or 1.2%, losing $85 and approaching $84.

Some analysts said that as tensions on the Israel-Lebanon border intensified, the risk of supply in the Middle East once again became a focus. In addition, mainstream investment banks such as Goldman Sachs, JPMorgan, and Citigroup all看好 the fuel demand brought by the peak of summer travel in the Northern Hemisphere and indoor cooling. U.S. oil and Brent oil have respectively accumulated a rise of 4.9% and 4.1% in June, reversing the downturn when the OPEC+ decision to increase production at the end of the year was just released.

Some analysts believe that the combination of geopolitical risks and bullish fundamentals may bring further upward pressure after Brent oil breaks through $85 per barrel. Others warn that if U.S. oil falls through $81 per barrel, the rise in oil prices may recede, and funds may start to clear long positions.

The European benchmark TTF Dutch natural gas futures once rose by nearly 3%, moving away from the lowest in nearly two weeks, and ICE UK futures also rose by more than 2% at the end of the day. U.S. natural gas August contract fell by 3%, once again approaching the lowest in two weeks, with a cumulative increase of about 11% this year. U.S. gasoline futures have risen by 19% this year.

The U.S. dollar rose, the yen once fell below 160 for several days, the offshore yuan hovered at a seven-month low, and Bitcoin broke through $62,000.

The U.S. dollar index DXY, which measures against a basket of six major currencies, once rose by 0.3% and approached 105.80. Last Friday, it once broke through 105.90 to the highest since May 1st, more than seven weeks, with a cumulative increase of 0.2% for the week and three consecutive weeks of increases.The euro fell 0.2% against the US dollar and once dropped below 1.07, approaching the lowest level in over seven weeks since late April, with a cumulative decline of 1% in June. The British pound rose slightly against the US dollar but was still less than the 1.27 mark, slightly detaching from the five-week lowest since mid-May. The offshore renminbi against the US dollar fell to its daily low at the beginning of the US stock market, once dropping below 7.29 yuan, then the decline narrowed, still hovering at a seven-month low.

The yen once fell to 159.79 against the US dollar, attempting to break through the psychological integer level of 160 for several consecutive days. During the US stock market, it slightly fell to 159.70, still hovering at the lowest level since April 29, which is also the lowest level in 34 years. The market speculates that 160 may be the warning line for the Japanese government to intervene in the foreign exchange market. The huge interest rate gap between Japan and the US has led to a cumulative decline of 1.5% for the yen in June, and a drop of more than 10% against the US dollar this year. On Monday, the yen against the euro once hit a historical low of 171.49, and against the British pound, it hovered at the lowest level in 16 years of 202.33.

Mainstream cryptocurrencies collectively rebounded, stopping the general decline for several consecutive days. The largest market value leader, Bitcoin, rose by 3% and returned to 62,000 US dollars. Yesterday, at the end of the US stock market, it fell by 7%, breaking through the psychological integer level of 60,000 US dollars, and once dropped below 59,000 US dollars, reaching the lowest level in nearly eight weeks since May 1. The second-largest Ethereum rose by more than 1% on Tuesday and broke through 3,400 US dollars, detaching from the five-week lowest since mid-May.

Spot gold fell below 2,320 US dollars to a one-week low, London copper hit a ten-week low, and New York cocoa futures fell by another 10%.

The US dollar and US Treasury yields rose together, suppressing precious metal prices. The COMEX August gold futures fell by 0.6% to 2,330.90 US dollars per ounce at the end of the day, and the COMEX July silver futures fell by 2.1% to 28.905 US dollars per ounce at the end of the day.

Spot gold fell nearly 19 US dollars or 0.8% during the day, breaking through the 2,320 US dollar integer level to a new low for the week. Last week, it approached 2,370 US dollars, the highest in two weeks, but fell sharply on Friday and turned down for the week. The gold price has fallen by more than 5% from the historical high of about 2,450 US dollars set on May 20. Spot silver fell by 2.5% during the day, breaking through the 29 US dollar level to the lowest in six weeks.

The rise of the US dollar led to a decline in most of London's basic metals. The economic barometer "Doctor Copper" fell by 90 US dollars or 0.9%, breaking through the 9,600 US dollar integer level, hitting the lowest level in ten weeks since mid-April. London aluminum fell slightly, less than 2,500 US dollars, still hovering at a two-month low. London zinc rose by 0.9%, London lead rose by more than 1%, London nickel fell by 0.9%,刷新ing the lowest level since early April in twelve weeks, and London tin fell by 1.5%.

New York cocoa futures fell by another 10%, hitting the lowest level in a month. Some analysts are concerned that the second-quarter global report to be released next month will show that record-high prices will damage demand. This year, cocoa prices have risen by 88%,有望创下 the best performance since 1980.

Leave a Comment